Protect Yourself From The Unexpected

NZ Vehicle Finance can arrange a variety of carefully selected insurance options for you, making sure you are fully protected.

From Comprehensive Cover to Mechanical Warranties, and GAP cover.

We can help you protect your car, your loans, and more.

Mechanical Breakdown Insurance

Protect Yourself from Costly Mechanical and Electrical Repairs.

At NZ Vehicle Finance, we have teamed up with New Zealand's top insurance companies to provide our customers with the best level of Mechanical and Electrical Breakdown Insurance available.

The warranties have been developed to offer you worry-free motoring so that you and your family can enjoy many years of driving your new vehicle on New Zealand roads.

The Mechanical and Electrical Warranty provides you with the peace of mind that comes from knowing that your vehicle is comprehensively covered for up to 4 years!

- Day One Cover

- Mechanical and Electrical cover

- 24-hour Nationwide AA Roadside Assistant

- Accommodation and rental car hire

- Repairs guaranteed

- Unlimited Km's

- Generous claim limits

- Claims settled directly with the repairer

- Policy period 1 - 4 year options

Car Insurance

MotorPlan - for worry-free motoring!

Caught in one of our motorway's nose-to-tails?

Walked back to your car to find it no longer where you left it?

Crack to your windscreen by flying stone?

We understand that sinking feeling you get when something happens to your vehicle. Our MotorPlan policy will help you pay for those nasty repairs and get you back on your wheels again. Protect your family, protect your investment and protect your lifestyle. With no stand-down periods and easy to understand policy wording, our MotorPlan policy is the no-fuss solution to your comprehensive insurance needs.

Offering

Easy Payment terms: Fortnightly, Monthly, Quarterly, Annual.

Direct Debit and Credit Card options.

- Up-to $1000 Trailer cover * excludes caravans, boat and horse trailers.

- Up to $1000 for accessories such as Navigation systems and child seats.

- Nil excess for windscreen repairs - $100 excess for replacement.

- *This is only a summary of cover, please see policy booklet for full terms, exclusions, conditions and benefits.

GAP Cover

What is GAP - Loan Enquiry Insurance

The Gap policy covers some of the difference (the gap) between a total loss payout on your vehicle by your comprehensive insurer and the balance owing under your credit contract. This is called a loan equity shortfall. GAP can only be purchased in conjunction with a credit contract, and in the event of a total loss that the credit contract must still be active. The vehicle must be comprehensively insured.

The contract is for a maximum of 84 months or the length of the original credit contact.

Can only be taken out at the time of vehicle sale.

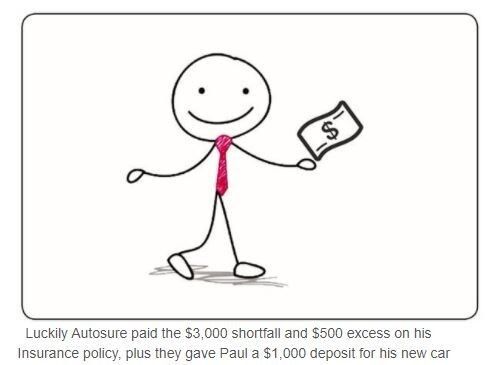

Additional Benefits Include

Comprehensive Motor Vehicle insurance premium in relation to the replacement vehicle.

Any Excess in relation to the total loss vehicle.

On Road Costs comprising of dealer delivery and registration related to the purchase of the replacement vehicle.

Deposit for a replacement vehicle up to $2000.

Reimbursement for out-of-pocket expenses up to $500.

Any amount relating to a prior debt is included in the credit contract.

Reimbursement for the cost of hiring a rental vehicle for a maximum of 5 days.

A GAP STORY - ONCE UPON A TIME, NOT SO LONG AGO...

Payment Protection Insurance

What is PPI - Loan Enquiry Insurance

Payment Protection Insurance is a policy which covers the policyholder for the instalments on their credit contract in the event that they suffer an insured event below. The policy cover options are specific to the policyholder’s source of income at the time of entering into a Credit Contract. The benefits are payable directly to the financier. In the unfortunate event of death, PPI covers the outstanding balance on the loan.- The main risk of having finance is if something happens to your ability to earn money. PPI protects you, your family and your credit rating if the worst happens.

- PPI protection truly covers you for the unexpected at the time you need it most.

- ACC only pays to a maximum of 80% of your income – How would your household react to an instant 20% pay cut?

What Cover Options are Available?

EMPLOYEE - Insured Events:Terminal Illness, Accident, Illness, Disability, Hospitalisation, Carer, Death, Suspension, Redundancy,

SELF-EMPLOYED - Insured Events:Death, Terminal Illness, Accident, Illness, Disability, Hospitalisation, Carer, Business Interruption.

EVERYDAY ESSENTIAL - Insured Events:Death, Terminal Illness, Hospitalisation, and Permanent Disability.

What are the Customer Benefits?

- No medical examination is required

- Redundancy benefit of up to 12 months

- Protects your household income for other purposes and your credit rating.

*This is only a summary of cover, please see policy booklet for full terms, exclusions, conditions and benefits.

SUPER FAST & EASY

We're here to help and do the hard work for you. Find out how easy it is - send a quick insurance enquiry or call our Customer Services team free on 0800 777 108 Monday - Friday 9am-5pm.